Calculate projected return on investment

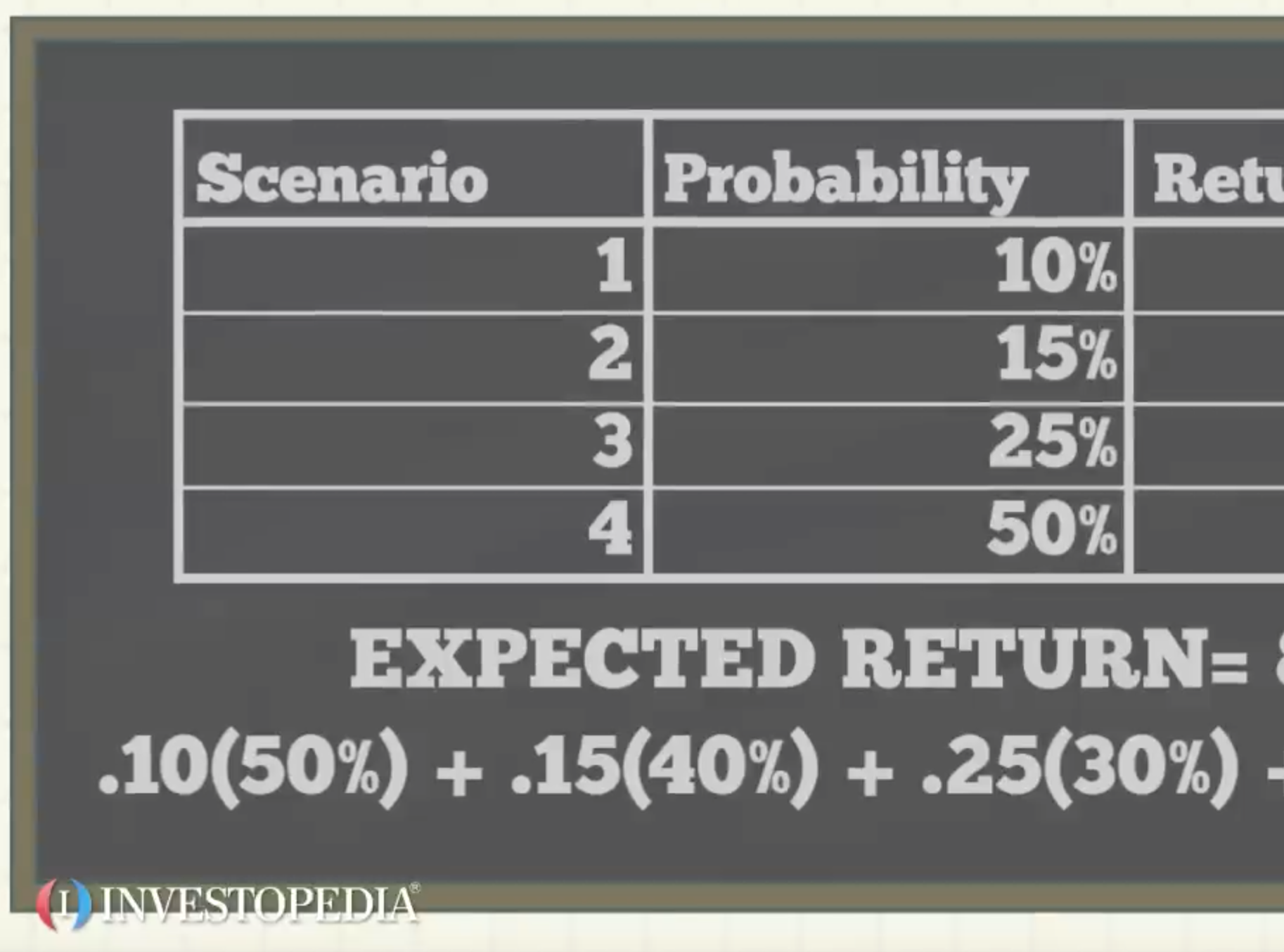

Learn how to calculate an investments expected return along with the value of the expected RoR formula. Because a return can mean different things to different people the ROI formula is easy to use as there is not a strict definition of return.

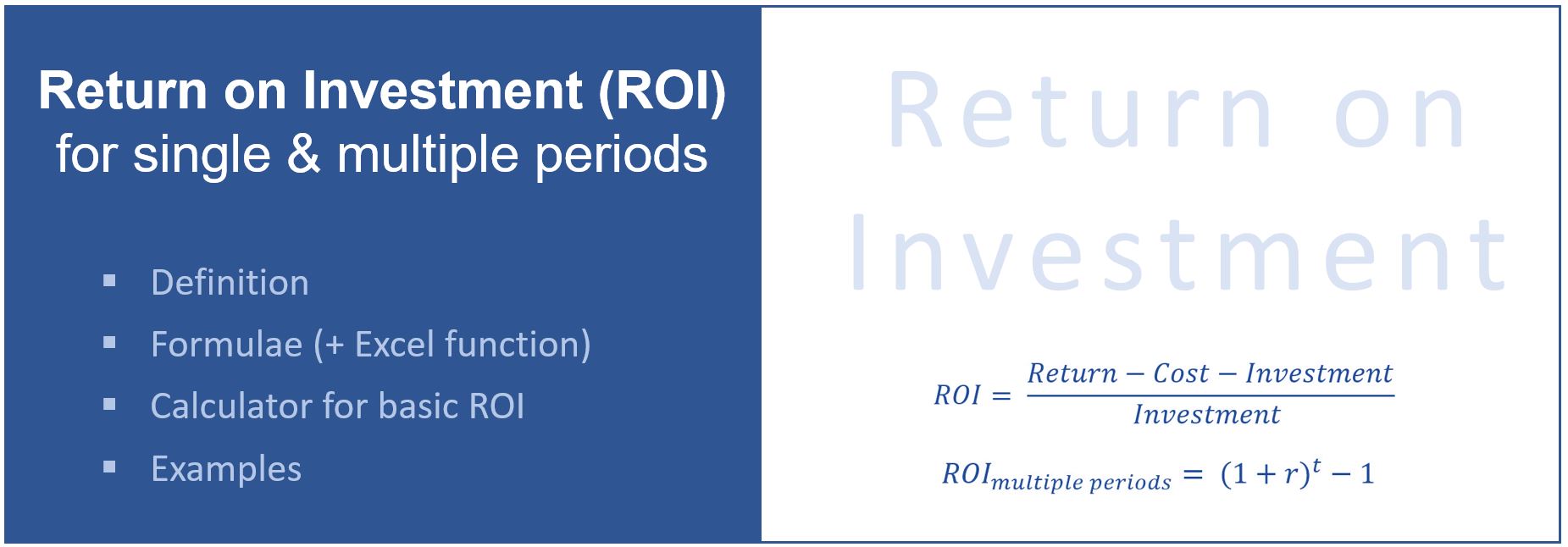

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Cash-on-cash return is a great metric for investors that are looking for cash flow as its easy to understand that a 20 cash-on-cash return of a 100000 investment yields 20000 per year.

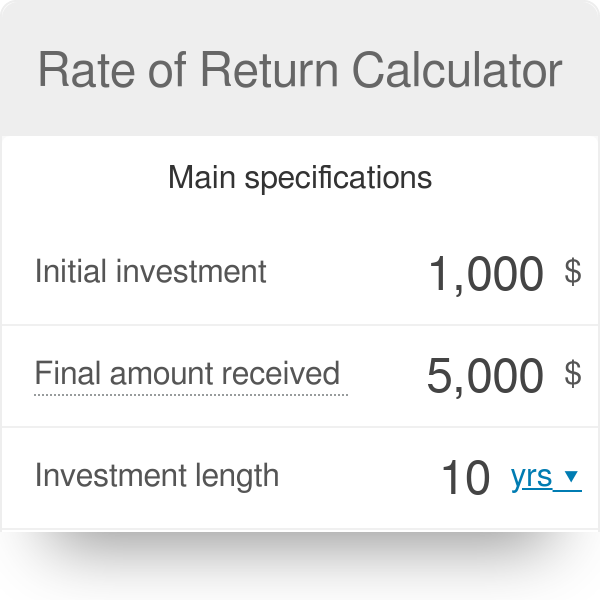

. Return on investment ROI measures how effectively a business uses its capital to generate profit. To calculate a 1-year annual return take the end-of-year investment value deduct the value from the beginning of the year and then divide it also by the beginning-of-year value. Condition investment purpose projected cash flows and profit opportunities etc.

Total Expenses 1000 x 2 100 2100. Rental Return per Year. Retirement Savings Calculator Am I saving enough for my retirement.

Investment return expressed on a yearly basis. The formula for calculating the average rate of return is. This free real estate investment spreadsheet will quickly allow you to calculate an investment propertys CAP rate IRR rate return NOI and help you determine the suitability of an investment property.

ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. The actual annual returns may be higher or lower than the estimated value. The return on investment metric is frequently used because its so easy to calculate.

In the lemonade example youre analyzing 3 years so youll need to use your formula 3 times. Yielders is an equity based crowdfunding platform for UK property investment offering prefunded assets to the crowd. Cash on cash return does not take into account the entire ownership period of the investment.

Average is a method for calculating the central point of a given data set and it is done. Calculating bottom-line return is just one consideration in making a business investment. With our online portal you can calculate potential returns.

Average vs Weighted Average Average Vs Weighted Average In Excel the words average and weighted average are different. How much do you spend a month on digital ads. Projected Net Annual Rent.

And it may have significant impact. You dont need to worry about your initial investment yetyoull use this in the next step. Then your actual revenues drop substantially compared to your projected revenues.

Berry says that every business expense including time resources and money is an investment. Calculate the daily rate of change for the price of the security. Normally the project or investment appraisal should be accepted if the IRR gives a higher rate of return than WACC.

Cash On Cash Return Vs. So in absolute terms the project or investment with a higher NPV value should be considered. The higher the ROI the better.

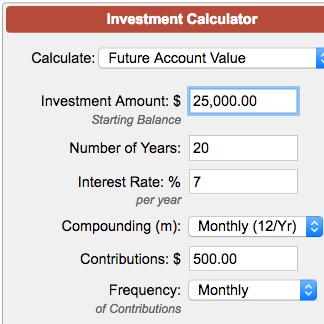

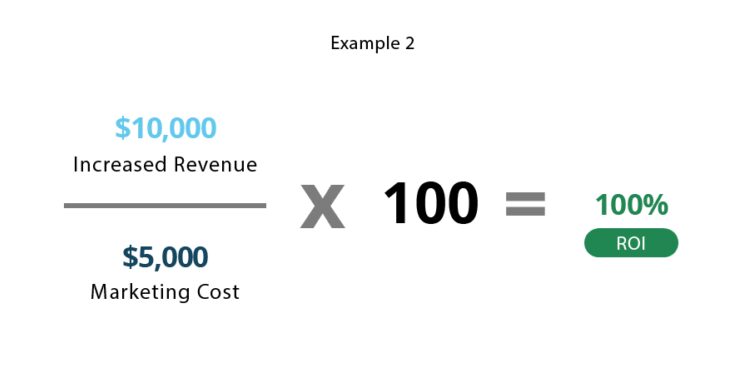

In order to calculate the return on ad spend ROAS marketers need to divide the revenue they gained from a set of ads by the cost of running those same. A target return is a pricing model that prices a business based on what an investor would want to make from any capital invested in the company. The calculations are based on projected annual returns.

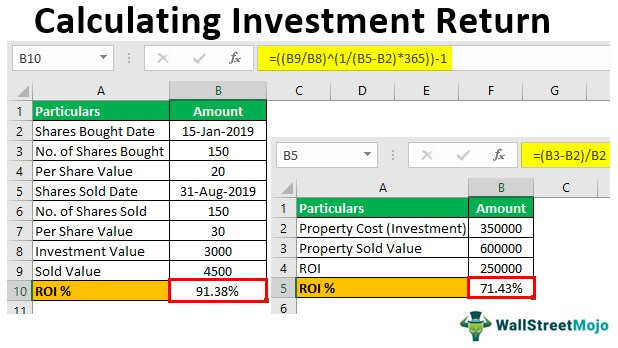

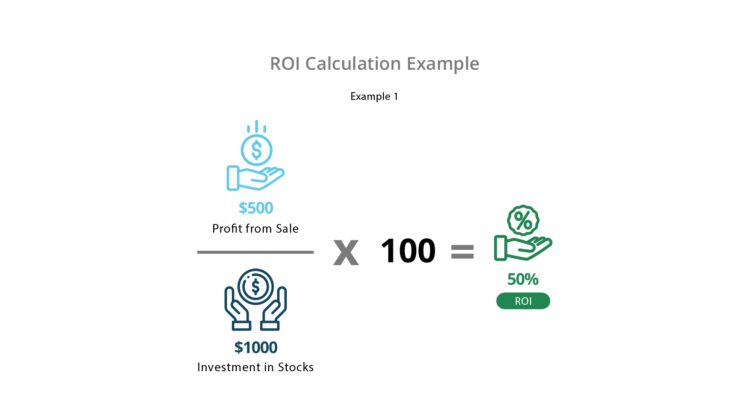

The result is a reduced net profit and a reduced actual ROI. To calculate the expected return on investment you would divide the net profit by the cost of the investment and multiply that number by 100. When the IRR calculated is applied for the same cash flows projected investments it may offer different results.

1 Simple and Easy to Calculate. Average annual net earnings after taxesInitial investment 100 read more. Calculate your yearly discounted cash flows as follows.

Its just a web based tool for getting a rough estimate about the future value on your SIP investments. My return was going to be 110 inside 3 years. Investment in mutual funds or any asset class comes with an inherent risk.

Target return is calculated as the. They are both very important but for different reasons. So if you have a stock paying 2 in dividends per year and is worth 20 and the dividends are growing at 5 a year you have a required rate of return of.

For each day this is calculated by dividing the change in price over two days by the old price. Average return is used to calculate the average growth rate which evaluates the increase or decrease of an investment over a given period. If you dont spend on ads now just test out a number 10 of your total marketing budget is a good place to start.

Essentially by looking at all the money you expect to make from an investment and translating those returns into the dollar value of the present day you can work out whether a particular. For instance if you have one investment that produced a 20 total return in three years and another that produced a 35 total return in five years. Only two figures are required the benefit and the cost.

Cash on cash return on the other hand focuses on profitability only in relation to the initial investment. This pre-retirement calculator was developed to help you determine how well you have prepared and what you can do to improve your retirement outlook. IRR calculations are determined using total cash flow initial investment costs and and the potential holding period.

RRR 2 20 05. Tim Berry is a developer of business plan software and says that sometimes it pays to forget the formal financial definition. Depending on the goals for your investment one metric will be more important than the other.

Projected dividend growth rate. Retirement can be the happiest day of your life. It is used in investment planning and capital budgeting to measure the profitability of projects or investments similar to accounting rate of return ARR.

Because of its several flaws when calculating the internal rate of returns investors and analysts use money-weighted returns as alternative options. Rental Return per Month. 50 1 004 1 50 1 04 4808.

Investment Calculator

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

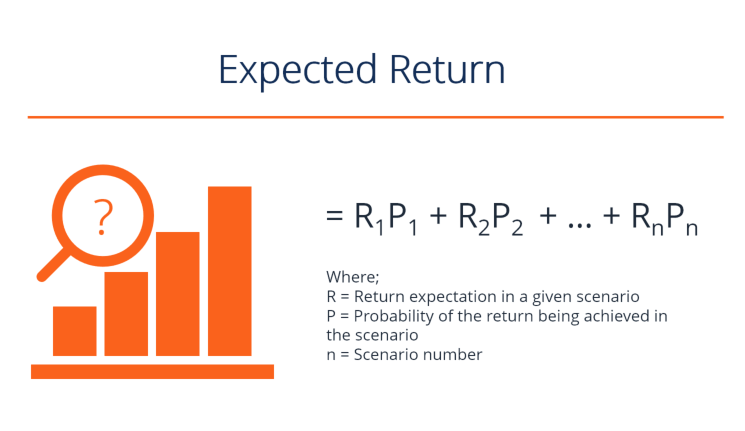

Expected Return Definition

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Definition Equation How To Calculate It

Rate Of Return Calculator

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Return On Investment Analysis For An Investor Plan Projections

Return On Investment Roi Formula And Excel Calculator

5 Easy Ways To Measure The Roi Of Training

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Formula Meaning Investinganswers

Calculating Return On Investment Roi In Excel

Expected Return How To Calculate A Portfolio S Expected Return

Return On Investment Roi Formula And Excel Calculator